DISCLAIMER

The present page is intended for teaching purposes only and does not apply to US traders. It shall not be intended as operational advice for investments, nor as an invitation to public savings raising. Any real or simulated result shall represent no warranty as to possible future performances. The speculative activity in forex market, as well as in other markets, implies considerable economic risks; anyone who carries out speculative activity does it on its own responsibility. The Authors accept no responsibility for any possible direct or indirect damage arising from the reader’s investment decisions.

Below content does not apply to US users

I’m sure you’ll agree with me when I say that trying to find the best eToro traders to copy is not as easy as it sounds.

There are thousands of traders on eToro, but not every trader is worth copying though they are obtaining remarkable results.

“Why” you ask? Well, we’re going to explain everything in this post.

But before getting started, here are the best eToro traders for the month of april.

Table of Content

Best eToro traders for April 2024

According to our methodology, the best eToro Traders for the month of April 2024 are:

1. Jeppe Kirk Bonde

Jeppe Kirk Bonde has a background in finance as a Strategy Consultant, having advised some of the world’s largest banks and tech companies. He doesn’t like leveraged and shorting positions and instead prefers accurate market analysis and diversification.

The trader suggests investing at least: $600

Risk Score: 4

2. Heloise Greeff

Heloise Greff focuses mostly on US Tech and Pharma companies. Her trading technique relies on an advanced machine learning IA that constantly analyses patterns. Her trading goals are long term, set from two to five years.

The trader suggests investing at least: $1000

Risk Score: 4

3. Christian Kongsted

An experienced Danish trader with seven years of experience and 15 years of investing experience overall, Christian focuses on Tech and Growth stocks while trying to keep his risk scores low. It’s worth noting that he is a former four times Scrabble Danish champion and an ELO 2280 chess player.

The trader suggests investing at least: $600

Risk Score: 4

4. Vicente Rodriguez

Vicente is a self-taught investor with a background education in Finance & Banking. As a Value investor, he is constantly seeking fundamentally undervalued stocks in order to keep them mid to long term. As a side strategy, he also invests a small percentage of his equity in Cryptocurrencies.

The trader suggests investing at least: $750

Risk Score: 4

5. Patryk Peltonen

As his eToro username “slow and steady” suggests, don’t expect huge volatility while you’re copying Patryk. This trader mostly invests long-term in ETFs, while hedging the already low risk with bonds and other assets.

The trader suggests investing at least: $500

Risk Score: 3

6. Boon Yoon Tan

As a growth investor, this Malaysian trade, who also works as an Insurance Agent, targets high potential companies and holds the shares for at least one to two years. Just like other traders who like to keep their risk scores low, he does not leverage or shorts any position.

The trader suggests investing at least: $500

Risk Score: 4

7. Zheng Bin

With three years of investment banking and ten years of trading experience, Zheng Bin does not have a fixed strategy. What he does do, is manage his money and investments extra carefully as though they were his life savings. It’s worth noting that is a member of Mensa.

The trader suggests investing at least: $500

Risk Score: 4

8. Jorden Boer

Jorden Boer is one of eToro’s Elite Popular Investors. He has over 20 years of experience in the world of finance. In his career he has worked at the Amsterdam Stock Exchange, and as a trader at several companies such as IMC. Jorden Boer’s strategy does not involve leverage, hedging or crypto investments.

The trader suggests investing at least: $200

Risk Score: 4

9. Wesley Warren Nolte

The official eToro Value investor Wesley Warren Nolte, after having sold his successful tech consulting business to a Fortune 500 company in 2015, has used his remarkable knowledge and insights in the tech field to get average yearly profits of +40% in the past five years.

The trader does not suggest any significant amount to invest

Risk Score: 4

10. Simone Rizzetto

Simone Rizzetto has a wide background in biotechnology and immuno-oncology, as well as an MSc in Computer Science. Because of this, he focuses mostly on Tech and Healthcare stocks while applying data analysis tools in order to keep risks as low as possible.

The trader suggests investing at least: $600

Risk Score: 4

Best eToro traders compared [April 2024]

Here is a comparison between the traders above:

| Trader Name | Risk Score | P/L (YTD) | P/L (last 3 months)** | Copiers | Minimum Copy* |

|---|---|---|---|---|---|

| Jeppe Kirk Bonde | 4 | +13,96% | +3,54% | 21900 | $600 |

| Heloise Greeff | 4 | +8,72% | +3,14% | 12700 | $1000 |

| Christian Kongsted | 4 | +22,45% | +10,09% | 15500 | $600 |

| Vicente Rodriguez | 4 | +6,45% | -1,17% | 1200 | $750 |

| Patryk Peltonen | 3 | +0,43% | -0,44% | 2000 | $500 |

| Boon Yoon Tan | 4 | +35,72% | +8,02% | 993 | $500 |

| Zheng Bin | 4 | +16,65% | -0,39% | 11300 | $500 |

| Jorden Boer | 4 | +8,85% | -6,99% | 14500 | $200 |

| Wesley Warren Nolte | 4 | +30,58% | +4,52% | 7400 | N/A |

| Simone Rizzetto | 4 | +34,82% | +11,40% | 952 | $600 |

* Suggested by the trader

** Past performance is not an indication of future results

How to find the best eToro traders with the search people filters

New on eToro?

Then it’s the perfect time to consult our eToro review to disclose any doubts you might have on this broker thanks to our full analysis, and then open a free Demo Account in few seconds and follow this procedure live.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results.

To look for the eToro best traders, or, as they used to say, the best Popular Investors, to copy in our portfolio we have an excellent search tool.

This tool can be accessed by the left menu, clicking on the “discover” icon, or by clicking on “search” if the menu is open.

Once you’ve clicked on the icon, scroll down until you find the investors section. Click “View all” for a better overview and filtering options.

At this point eToro will provide one of its pre-programmed research to try to assist you.

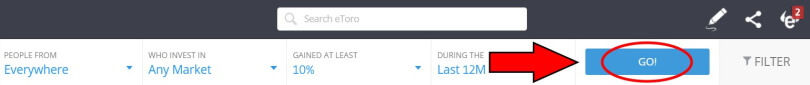

Go ahead and click on “GO”.

If you’re satisfied with the stock filters, you can go to the next step. But if you would like to know how we look for the best eToro traders, you must remove all the filters by clicking on each “X”.

From now on you will start from zero and you’ll learn an independent and professional method.

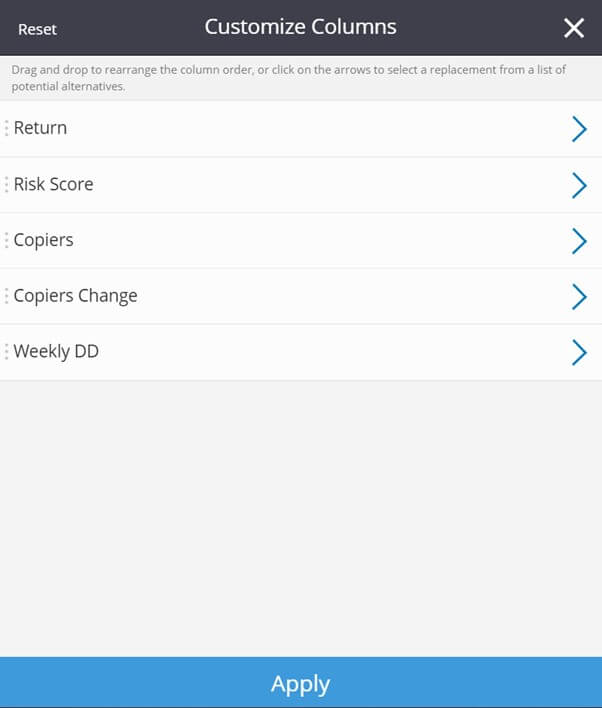

You can notice you have 5 columns with 5 different data:

- Return

- Risk Score

- Copiers

- Copiers Change

- Weekly DD

First fundamental point.

Many people are unaware that there are several other data you can visualize and study.

Some are very important and you will not even find them in the trader’s personal profile!

To find them, click on this symbol.

Then, by clicking on each of the four columns, all the other data will appear.

By clicking on each column header you can choose which information to display. Once you have made your choices, to confirm just click on the “apply” button in the bottom.

Soon I’ll reveal to you what are the most important data to look at that no one else around will ever tell you.

But first, it’s important to understand what these data mean.

If you want to become a real professional and really learn our procedure to find the best eToro traders to copy it’s essential to know all the values.

List of available data about the eToro traders

– User Data Column

In this first column we can find the basic user data, i.e. his username, his country of origin, a photo, and the symbol that indicate if he’s a Popular Investor or just a Verified Trader.

“Verified” means that the trader has performed the procedure for confirming his account with eToro, sending all the required documents to prove his identity.

In the list, a verified trader is identified with the green flag symbol.

A Popular Investor instead is a trader, already verified, that in addition has decided to participate in the homonymous program, to gain access to additional earnings recognized by eToro according to merits, primarily on the number of copiers. In return, the trader agrees to show his real name and a real photo, both controlled by eToro.

On the one hand eToro empowers traders showing their true identity, on the other investors are sure to be investing on real people, who have put themselves into play in the first person, without hiding.

Needless to say that it is highly recommended to use the “Verified” flag, to show only the people at least verified, together with all the Popular Investors, of course.

– Return Column

Unlike previous years, where in the counting of the performance there were also the commissions earned by the trader for the copy trading activities (something had nothing to do with the real ability of the trader to operate in the markets), today the figure is calculated by a simple formula that excludes from counting any deposit or withdrawal, and returns what was gained (or lost) by trading activity only.

Although there is no limit to the ability of a trader, you should always have a critical eye, and be wary not only when numbers are too low, but even when they are too high, of course, always in view of the selected Time Period.

When trading, there are no gains without risks, so very high gains may hide risks as high.

– Risk Score Column

Is a very important data, obtained from an eToro proprietary formula, which tries to give a general vote on the dangerousness of the traders in question, based on different values, including in particular the instruments traded, their volatility and the leverage used.

– Copiers Column

The number of copiers, i.e. of the investors who are replicating with real money the trading signals executed by the trader. EToro usually sorts the list by this figure.

It’s like a popularity rating of the trader. You should, however, be extremely careful, because popularity is definitely not enough to make optimal choices.

There are quite frequent cases of traders who, in favorable periods, have become very copied for a simple ripple effect, where investors have copied the choices of other investors without objectively analyzing the performance of the trader. Many of them have had unpleasant surprises.

This is a classic case of failure of the wisdom of the crowd in Social Trading (learn how this works in social trading and what may happen to you if you don’t make your analysis) because investors did not evaluate the data independently (principle of independence), but they get influenced by the perception of others.

So, always take this data very carefully. We will see later how to properly take advantage of it.

– Copiers Change Column

This figure shows the percentage change in the total number of copiers of that trader.

Do you want to look for those on the rise that are becoming popular because they are having good performance? Then the values must be positive.

Do you want to look for those traders recently abandoned by the crowd to see if there are some that are still worthy? Then the values should be negative.

– Weekly Drawdown Column

Always within the selected Time Period, this figure indicates the value of the maximum decrease on the assets recorded in the worst week.

The drawdown is definitely one of the most important data for performance and especially risk analysis, which is why we have dedicated a whole lesson of this course (and also of the Social Trading’s one) to this element, to learn precisely how it is calculated by eToro.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results.

Additional Columns about the eToro traders

The columns above are the standard ones set by eToro. Of course, it’s possible to customize them by clicking the “Gear Icon”

– Return

Similar to the daily return column, this setting will show the total return of the trader from the day it opened an eToro account.

– Daily Drawdown Column

As above, but referred to the drawdown of the worst day of the period in analysis. Both figures are a good starting point for imagining how you would feel on that particular day or week.

– Profitable Months Column

The percentage number of times that the trader was able to close a month with a profit. It thus shows the consistency and the ability of the trader to generate profits.

However, it must be put into context with the style of trading, because for example, a long-term trader could also have a low percentage, but at the same time still be highly profitable in terms of performance.

– Active Weeks Column

The number of weeks in which the trader has been active, performing operations.

It has to be considered obviously together with the selected Time Period. It’s an indication of how dynamic the trader is, and if by chance he stops trading in some periods.

– Average Trade Size Column

This is a very interesting data provided by eToro, and is also interesting to know how it is calculated.

It’s an average value of the Amount invested in each operation divided by the relative Realized Equity.

Basically, every time a new trade is opened, the system divides the Amount value (in other words, the margin blocked by the broker) for the Realized Equity of that moment (which is Account Balance + Invested Amount, or Equity – Net Profit) , to then make an average of all the values.

This calculation indicates how many resources the trader uses to open a new trade, and it’s very important because a resource used is equivalent to a resource risked.

Being performances equal, a lower Average Trade Size indicates that the trader was more efficient in using his fund to get results.

– Profitable Trades Column

Is a simple winning percentage. It indicates the percentage of transactions the trader was able to close with a profit.

Even here, the temptation might be to prefer investors with high percentages, with almost or precisely a 100%. It could seem that they are so good to never fail a trade.

Let me tell you very frankly: traders who are never wrong do not exist. When trading, it is normal to lose sometimes.

The only reason he may have such a “perfect” percentage is simply that, as a strategy, he never closes a transaction when it is losing, but he lets it run in the hope that sooner or later it will come back into profit.

Needless to say how risky this is, as the market sometimes does not come back in any case, and does not take any prisoners.

This is only one example of the risks you may encounter with social trading. Keep studying with InvestinGoal’s lessons and learn how to recognize dangerous situations and how to avoid them.

– Trades Column

This figure indicates the number of operations performed in the selected timeframe. The frequency with which a trader works is very important, especially to be able to control his behavior.

Furthermore, some traders operate way too frequently.

Now that you know the meaning of all the data, let’s look at the search filters.

After that, you’ll have everything you need for the best eToro traders search procedure.

Functions of the eToro Traders Search Filters

Here’s all the filters you have available:

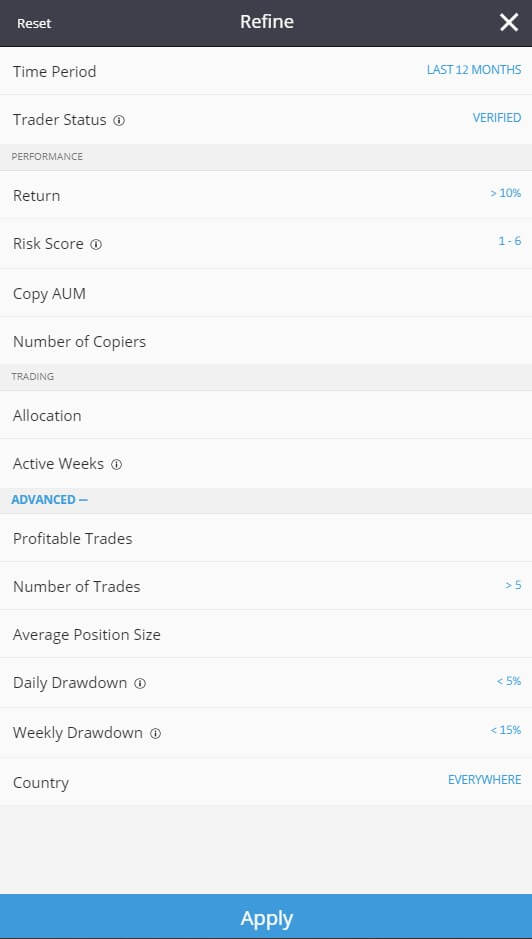

– Time Period Filter

We start again from the Time Period filter. An ideal starting point is to use the last 2 years to have as much data as possible and start finding some good traders to be deepened.

Sometimes it might be useful to use a very close Time Period, such as Last Month, to find good traders who are in optimal stages to be included in the portfolio.

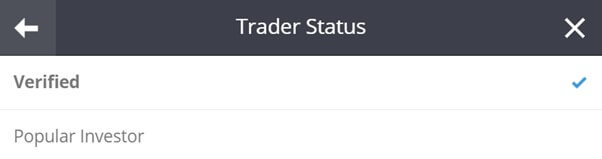

– Trader Status

A trader can have 2 statuses: Verified and popular investor, with the first one meaning that the trader has simply successfully gone through the whole eToro identity verification.

While the second one is both verified and has also traders copying him already.

– Performance Filters

There are 4 in total: Return, Risk Score, Copy AUM, Number of Copiers

Return: how much the trader has earned/lost

Risk Score: the eToro algorithm ranks traders from 1 to 10, with 1 being the lowest risk score and 10 the highest. The higher the risk score, the higher can be the potential return and losses

Copy AUM: How much money the trader is managing. If 10 people invested $500 in a trader, he will have $5000 AUM.

Number of copiers: The total number of people who are copying the trader

– Trading Status

There are 2 in total: Allocation, active weeks

Allocation: filter the traders by what they are investing into.

Active Weeks: a week is considered active if the trader had at least one open position for the whole week.

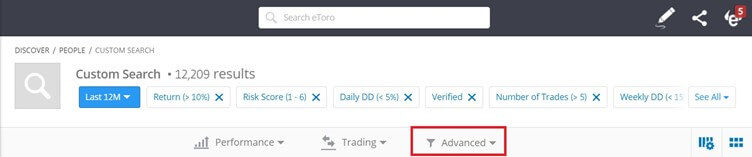

– Advanced Filters

Here you can choose from 6 different eToro filters.

Profitable Trades: filter the traders by their trading performance. Remember that a high profitable trades percentage doesn’t necessarily mean that the trader is operating wisely.

Number of Trades: filter the eToro traders by their trading activity. The more trades they have, the more active they may be.

Average Position Size: filter the traders by the average size of their trading positions. It can be useful to choose them according to the amount of money you want to invest.

Daily Drawdown: Filter by the worst daily drawdown

Weekly Drawdown: filter the traders by their weekly drawdown

Country: filter the traders by their nationality or country of residence

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results.

Step by step procedure to find the Best eToro Traders to Copy

At this point we are ready to begin to “play” with data and to use these filters to find the most expert traders.

Here is the step by step procedure.

How to filter and find the best eToro Traders to copy

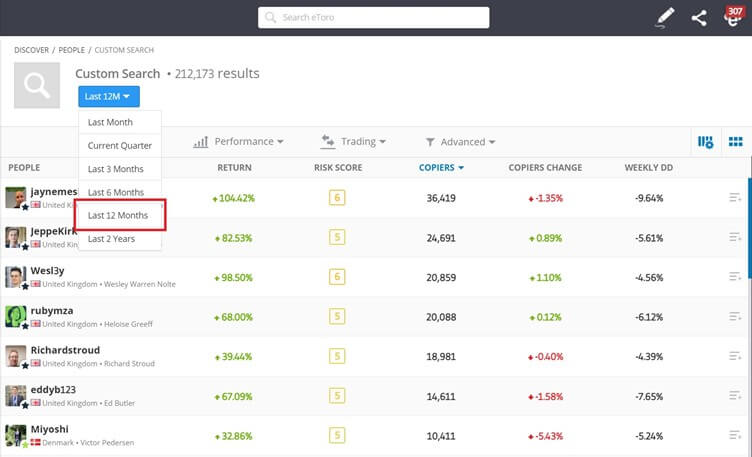

1. Take into account the last 12 months

It’s important to look at least at one year of data, even better if 2 years, so either “Last 12 months” or “Last 2 years”.

Try to do this research with both values.

2. Verify the status of the eToro trader

We want to be sure to evaluate only real people whose veracity of the personal data has been thoroughly checked by the eToro team.

Traders who have joined the “Popular Investor” program are still too few, so we avoid this filter to not limit our search too much.

3. Make sure the trader has had positive returns

We are all here to make profit, so if a trader in a year has not been able to generate at least a 10% return maybe he’s not the right choice.

Obviously, if in the first filter you put “Last two years”, here you have to enter 20%.

4. Ignore traders using dangerous techniques

This is the first important filter and you will find it in the “advanced filter” section.

In the first place we must remove the traders that have too low winning percentages (for obvious reasons), but also and above all those with too high percentages.

If you know a bit about InvestinGoal you’ll understand right away why.

Just a quick refresher, too high percentages (which for us are from 80% upward) are not a sign of skill, but only of trades management techniques like the Averaging Down or the Martingale.

Both techniques essentially involve not to close the loss-making trades, but to open others to compensate and recover the losses more quickly. By never closing the loss-making trades, the winning percentage obviously remains very high.

These techniques can be effective in some cases, but if you are not really good at managing them, most of the time they are a sure recipe for failure.

If the lower limit of 40% seems too low, consider that some top expert traders get excellent profits with those percentages.

In a strategy, the percentage of success is not the only thing that counts, there’s also how much it earns on average with profit-making operations, and how much on average with loss-making ones. This is called Risk-Return Ratio.

5. Take the risk score into account

EToro has developed a Risk rating system of the trader’s strategy.

This rating is calculated by taking into account various elements, in particular the average volatility of the instruments on which the trader operates.

The more volatile the instruments, the more volatile the portfolio that contains them, and therefore the greater the risk.

Values above 6 start to be high.

6. Look for portfolio diversification

This value is very important, because it quickly removes all those traders who invest too large percentages of the asset in each operation.

If the percentages are too high it only takes a few wrong trades to burn much of the account. Better to avoid those who exaggerate.

And with this, we’ve finished the series of filters to be added. Here is a graphic summary before moving to the columns’ management.

Let’s proceed to insert the columns with the necessary data to find the best eToro Popular Investors.

7. Filter the traders by market exposure

You can use this filter if you’re interested in copying a trader that invests money in a specific market. All you need to do is inserting the minimum and maximum allocation percentage of the selected market, and the system will automatically filter the traders based on this information.

Set a minimum amount of at least 1%, while the maximum amount should be decided depending on your needs:

If you’re looking for a trader that mainly trades stocks, choose a high maximum shares allocation percentage (let’s say 80%). If you’re looking for an investor that dedicates a small amount of its portfolio to cryptos, choose a small crypto allocation percentage (let’s say 10%). Again, the maximum depends on what you’re looking for.

8. Organize the columns on the eToro Platform

As explained before, we can change the values we want to see in the 5 available columns by clicking the “gear icon” (see the screenshot below). All you have to do is select the information and select the new one you want to display. Once you’ve done this, click the “apply” button.

By default, eToro displays the following column data: Return, Risk score, Copiers, Copiers change, and Weekly Drawdown. In order to visually display the data we’ve set up during the 4th and 6th steps, swap the columns with these information:

- Risk score > Profitable Trades

- Copiers Change > Average Trade Size

The risk score is important, however remember that we’ve already set-up a specific filter to avoid traders with risk score above 6.

9. Check the profile of each eToro Popular Investor

Time for some manual steps. Start by sorting them by copiers by clicking on the “copiers” column. Then, one by one, starting from the top, have a look at the personal profile of each trader by opening their profile on a new tab (right click on their name).

Once you’ve opened a profile, for now don’t start to check all the data, it’s not yet time.

To slim down the list further and focus only on the best eToro traders, take a look at the Equity Line of the trader’s account.

How?

Get in the Chart section and click on the icon on the right.

For a better analysis, we also recommend using the eToro ProCharts feature. Once you’re on the chart section, select the Gear icon on the right and then “Launch ProCharts”.

Here eToro shows a real Equity Line of the trader’s account (for privacy rules it doesn’t show the real money balance but it’s all created on a hypothetical initial account of $ 10,000).

From here, select the “Last two years” period to see as much as possible.

Now quickly see the equity shape.

- First of all, is it in profit?

- Is the trend pretty much constant?

- Can you find some very strange moments?

- How are the drawdowns?

With a little practice (and taking into account the March 2020 market crash) you will just need a little look to select the most attractive equities and discard the others.

Remember to always observe the equity for two years, because you need the most visibility in this case.

Below there are some examples of equity lines of good traders in our opinion.

When you find one worthy, go back to the Trader Search page, click the “+” button and add that trader to a list called “Best eToro Traders by InvestinGoal”.

Go on with the “one trader at a time” procedure.

In about 10 minutes you should have found at least 30 good traders to add to the new list and to move to the next phase 3.

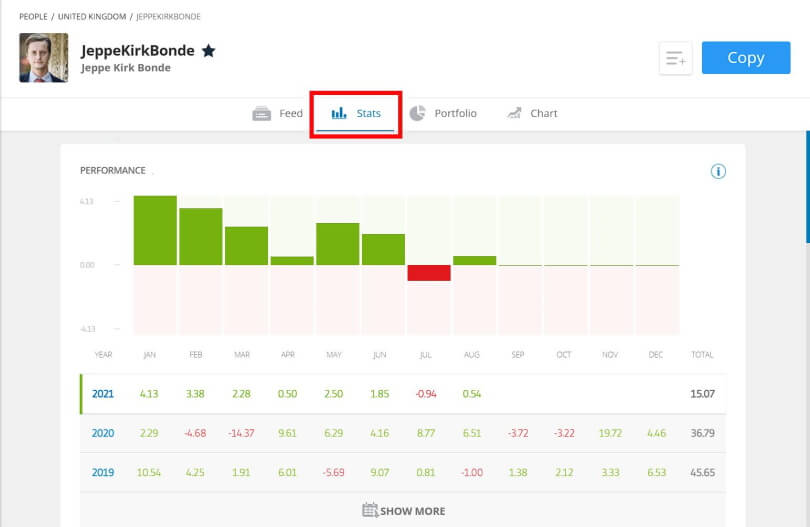

10. Evaluate each eToro Trader to potentially copy

The first rule for success is being organized, however there is some data that won’t be directly displayed into the columns, but must be searched directly onto the trader’s profile.

These are the Average Trade Size, detailed exposure data, and many others.

So, the solution here is to organize the data to work efficiently and avoid constantly jumping back and forth to observe all the interesting data of each trader.

For this kind of thing there’s nothing better than Excel.

Open a new Excel worksheet, and fill the columns with what you may find interesting by visiting the profile of the eToro traders you may be interested in copying (see “Stats” section).

Let’s say we’re interested in Stocks, ETFs and Cryptocurrencies, and that we want to make sure the trader has had a solid trading strategy through the years.

In this case we may add the following columns:

- Returns in 2019

- Returns in 2020

- Returns YTD (Year to date, meaning since Jan. 1st 2021)

- Exposure columns (Stocks, ETFs, Cryptos, Other)

We recommend monitoring the traders for a while in order to have the most accurate data. In fact a trader may have to increase the exposure to a certain market for a limited period of time, which may result in data contamination.

11. Edit the eToro filters if needed

At this point, you are already able to follow a professional strategy to find the best eToro traders, based on a theory, and especially on specific values.

The downside of using precise search parameters is that you will inevitably leave out some traders who were at the extreme limit of those values.

So a simple trick to find dozens of other worthy traders is to repeat the procedure, but removing or editing a filter from time to time.

Obviously, the values then must be checked even more carefully, to avoid bad surprises.

Edit the market exposure percentage little by little to find new potential eToro traders to copy.

You can also try to remove the winning percentage. It can be dangerous though, so be extra-careful when analyzing the new-entries.

The 10% minimum return can also be removed. It may happen that the trader was in drawdown due to an unlucky trading year or a market crash. In any case, the reason behind the DD must be analyzed before investing in said traders.

Remove or edit the average trade size. If a trader knows what he’s doing he may exceed the 5% we have set, but the filter would not allow us to see his profile.

Editing the Risk score can be useful. Crypto traders may have averagely higher risk scores than, for example, stock market traders. Or the market may be crashing, so the risk scores of all traders would rise a little bit, though their strategy was efficient until that moment. This is why you may need to edit the maximum risk score in order to find more traders.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results.

Other tips to find the best eToro Popular Investor

Here are some additional tips to refine your search.

TIP #1: Observe the daily, weekly, and annual DD data on the trader profile. Understanding and analyzing the Drawdown is absolutely important.

TIP #2: With eToro you can actually see the trading history of every trader, so you can analyze the trading strategy of the eToro popular investor you are planning to copy. All you have to do is visit the “History” on the Portfolio section of the trader profile. You can also add filters to further analyze the trader’s performances.

TIP #3: As a general rule, but not absolute, it is better to prefer traders who focus/specialize on few instruments or markets: let’s say for example Tech companies in the stock market, major USD forex pairs, or Commodities CFD Futures. However, the opposite is also true. What actually matters, is that the trader knows what he’s doing.

TIP #4: eToro is the biggest social trading network around, so why not take a look at the feed section of the trader’s profile? See how he behaves, if he shares the reasons for his choices, if he proves to have a strategy, if he answers to his followers’ questions, and so on. These things are important if you decide to really follow him.

Tips found on the web… that I don’t understand

While writing this post I also did a search on the web to see what other websites were writing.

I came across some tips whose logic I didn’t understand. Let me show you them so that you can reason with me.

STRANGE TIP #1: Preferring traders that make a lot of operations.

Honestly, I don’t care about “how much”, but I care a lot about “how”. Given the fact that too many executed trades can be indicative of risk (scalping), for me, a trader can also operate little, what’s important is the performance and how he opens those traders, according to which strategy.

What certainly matters is to have data of at least one year.

STRANGE TIP #2: Avoiding those traders that copy others.

If one is a real trader, he’s also able to recognize another real trader. If I find a good trader that, in addition to his operation, also follows someone else’s, I do not see any problem.

The important thing is that he doesn’t overdo it. Indicatively, I don’t exceed 20%, but even in this case it depends.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Trading history presented is less than 5 complete years and may not suffice as basis for investment decision. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest in cryptocurrencies unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.