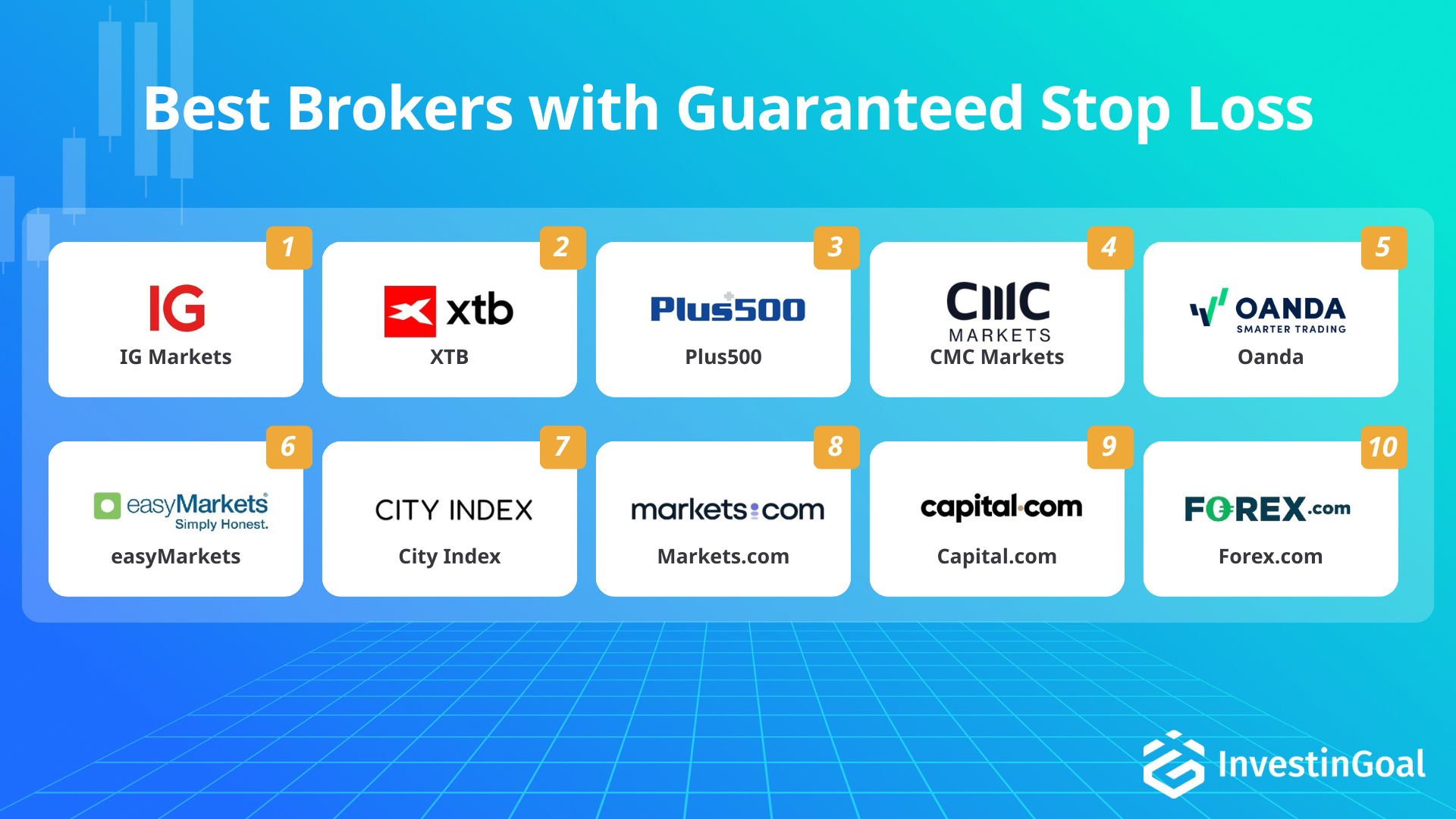

The best Forex brokers for guaranteed stop-loss orders are IG, XTB, Plus500 and CMC Markets.

When choosing the best guaranteed stop-loss orders FX broker, GSLO availability and premium structure, regulation and client protection, overall trading costs (especially EUR/USD spreads), and platform + account features (demo access, minimum deposit, and MT4/proprietary options) are the most important criteria.

IG is the best guaranteed stop-loss orders Forex broker overall, thanks to offering GSLOs with no upfront premium (charged only if triggered), strong regulation and client safeguards, competitive major-pair pricing, and well-rounded platforms and account tools (including demo and MT4 support).

Ranked just behind IG, the best guaranteed stop-loss orders for Forex brokers for pricing, platform usability, and risk controls include XTB, Plus500, and CMC Markets. XTB provides a $0 minimum deposit and the xStation 5 platform with typical EUR/USD spreads around 0.7–1.0 pips. Plus500 features Guaranteed Stop Orders on select instruments, with the cost paid upfront via a wider spread. CMC Markets supports GSLOs where the premium is charged only if triggered, alongside tight spreads and Next Generation/MT4 platform access.

XTB and Plus500 also feature prominently in the best Forex brokers ranking due to competitive pricing, robust platforms and tools, and multi-jurisdiction regulation.

IG Markets

(Best Guaranteed Stop Loss Forex broker overall)

IG is the best guaranteed stop loss Forex broker thanks to no-upfront-premium GSLOs that close at the exact stop price, MT4 alongside its proprietary web/mobile platforms, and EUR/USD spreads from 0.6 pips (typical 0.8–0.9). IG is an exceptional choice for overall GSLO trading because you pay the GSLO fee only if the stop is triggered, which means you only pay for protection when you actually use it. The no-upfront GSLO pricing of IG protects traders from slippage by guaranteeing the exact exit price they set.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

IG Markets Features

The features of IG Markets are listed below.

- IG offers guaranteed stop loss orders on CFD and spread betting trades that close positions at the exact stop price with no slippage.

- IG charges no upfront GSLO premium and IG charges the GSLO fee only if the stop is triggered.

- IG offers a free demo account and IG supports its web platform, mobile app, and MetaTrader 4.

- IG is regulated by the FCA, ASIC, CFTC and NFA, MAS, and other major regulators across regions.

- IG has no minimum deposit, and IG recommends starting with about $250 or equivalent.

- IG EUR/USD spreads start around 0.6 pips and average about 0.8 to 0.9 pips on standard pricing.

IG Markets Pros and Cons

Advantages of IG Markets

The advantages of IG Markets are listed below.

- Low spreads from 0.6 pips on Forex

- Wide range of financial instruments

- 40 years of experience in the Forex industry

Disadvantages of IG Markets

The disadvantages of IG Markets are listed below.

- No copy trading features

- No social trading features

About IG Markets

IG Markets is a global online trading provider founded in 1974, offering access to over 17,000 financial markets including forex, stocks, indices, commodities, and cryptocurrencies. IG Markets provides proprietary trading platforms alongside MetaTrader 4 and ProRealTime. IG Markets is regulated by multiple top-tier authorities worldwide, including the FCA and ASIC. IG Markets is known for competitive spreads, extensive educational resources, and innovative features like weekend trading. The IG Markets’ parent company “IG Group” CEO is Breon Corcoran.

XTB

(Best Guaranteed Stop Loss shortlist pick for xStation)

XTB is the second best guaranteed stop loss Forex broker due to xStation 5’s stop and trailing-stop controls, regulated account protections like negative balance protection, and typical EUR/USD spreads around 0.7–1.0 pips. XTB is an outstanding option for xStation because xStation 5 supports market, limit, stop, and trailing stop orders, which makes it easier to predefine exits and manage risk on every trade. The xStation stop-management toolkit of XTB helps traders control downside with predefined exit levels, but gap slippage remains a key risk because stops can fill worse than requested during fast moves.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

XTB Features

The features of XTB are listed below.

- XTB has a $0 minimum deposit for opening an account.

- XTB is regulated by the FCA, CySEC, Poland KNF, DFSA, FSC Belize, and other regional authorities.

- XTB provides a free demo account that runs for 4 weeks by default.

- XTB trades via xStation 5 on web, desktop, and mobile and XTB does not offer MetaTrader to new accounts.

- XTB EUR/USD spreads typically run around 0.7 to 1.0 pips on the standard account with no commission.

XTB Pros and Cons

Advantages of XTB

The advantages of XTB are listed below.

- No minimum deposit

- Wide selection of assets

- Competitive trading costs

Disadvantages of XTB

The disadvantages of XTB are listed below.

- Small withdrawal fee

- No social or copy trading

- XTB demo account is limited to 30 days

About XTB

XTB is a global forex and CFD broker founded in 2002 and headquartered in Poland. XTB offers trading on over 2,000 instruments including currencies, stocks, indices, commodities, and cryptocurrencies. XTB provides the proprietary xStation platform and is regulated by multiple authorities including FCA, CySEC, and KNF. XTB is listed on the Warsaw Stock Exchange and serves over 897,500 clients worldwide. The XTB CEO is Omar Arnaout since March 2017.

Plus500

(Best Guaranteed Stop Loss Forex broker for simple app)

Plus500 is the third best guaranteed stop loss Forex broker thanks to Guaranteed Stop Orders that close at your specified price even if the market gaps, a simple proprietary web/mobile app, and strict GSO rules (set at trade entry and cannot be removed) with an upfront spread premium. Plus500 is an excellent choice for a simple app because the platform is designed for straightforward manual trading. The guaranteed stop is locked in at trade entry so your maximum loss is defined from the first second. The Guaranteed Stop Order setup of Plus500 protects traders from slippage by guaranteeing execution at the stop price, even if the market jumps past the level during a gap.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

Plus500 Features

The features of Plus500 are listed below.

- Plus500 offers guaranteed stop orders on select instruments that close trades at the stop price even if markets gap.

- Plus500 prices the guaranteed stop through a widened spread premium, and Plus500 requires the guaranteed stop at trade entry with no removal once set.

- Plus500 minimum deposit is $100.

- Plus500 is regulated by the FCA, ASIC, CySEC, and additional regulators in multiple jurisdictions.

- Plus500 provides an unlimited demo account and Plus500 uses a proprietary web platform and mobile app only.

- Plus500 EUR/USD spread averages around 0.8 to 1.1 pips on standard pricing.

Plus500 Pros and Cons

Advantages of Plus500

The advantages of Plus500 are listed below.

- Well-regulated CFD provider

- Over 2000 tradable CFDs

- Unlimited demo account offered

Disadvantages of Plus500

The disadvantages of Plus500 are listed below.

- Limited Regulatory Protections for Professionals

- Inactivity fees

- Limited deposit methods

About Plus500

Plus500 is a global fintech company founded in 2008, offering online Futures trading services in different markets such as Agriculture, Cryptocurrencies, Metals, Commodities, Forex, Interest Rates, Energy and Equity Indices. Plus500 provides proprietary web and mobile trading platforms. Plus500 is regulated by multiple top-tier authorities including FCA, ASIC, and CySEC. Plus500 is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. The Plus500 CEO is David Zruia since April 2020.

CMC Markets

(Best Guaranteed Stop Loss Forex broker for refundable premiums)

CMC Markets is the fourth best guaranteed stop loss Forex broker thanks to refundable GSLO premiums (charged only if triggered), flexible GSLO management that lets you modify or switch back to a normal stop, and tight EUR/USD spreads around 0.7 pips. CMC Markets is a great option for refundable premiums because the GSLO fee is shown before placing the order and is refunded in full if the guaranteed stop is never triggered, so you don’t pay for protection on trades that stay within normal volatility. The refundable GSLO premium model of CMC Markets protects traders from gapping by locking the exit at the exact stop price.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

CMC Markets Features

The features of CMC Markets are listed below.

- CMC Markets offers guaranteed stop loss orders on most CFD and spread betting instruments to lock in an exact exit price through volatility.

- CMC Markets charges the GSLO premium only if the stop triggers and CMC Markets refunds the premium in full when the GSLO is not triggered.

- CMC Markets has no fixed minimum deposit, and CMC Markets recommends about $100 to start with adequate margin.

- CMC Markets is regulated by the FCA, ASIC, MAS, IIROC, and other authorities across its operating regions.

- CMC Markets offers an unlimited demo account and CMC Markets supports the Next Generation platform plus MetaTrader 4.

- CMC Markets EUR/USD averages about 0.7 pips on the standard account, and CMC Markets FX Active targets about 0.6 pips total with a $5 per lot commission.

CMC Markets Pros and Cons

Advantages of CMC Markets

The advantages of CMC Markets are listed below.

- Regulatory Trust

- Low Trading Costs

- Extensive Trading Platform

Disadvantages of CMC Markets

The disadvantages of CMC Markets are listed below.

- Complex Fee Structure

- Limited Funding Options

About CMC Markets

CMC Markets is a global online financial trading company founded in 1989 and headquartered in London. CMC Markets offers trading on forex, indices, commodities, cryptocurrencies, and shares through CFDs and spread betting. CMC Markets provides proprietary and MetaTrader platforms for desktop, web, and mobile. CMC Markets is regulated by multiple authorities including FCA, ASIC, and BaFin. CMC Markets is listed on the London Stock Exchange. The CMC Markets CEO is Lord Peter Cruddas.

Oanda

(Best Guaranteed Stop Loss Forex broker for API trading)

OANDA is the fifth best guaranteed stop loss Forex broker thanks to GSLO availability outside the US on select products, transparent premiums shown in the order ticket that only apply if triggered, and robust API access for automated execution. The API access of OANDA ranks it among the strong choices for API trading with GSLO protection because automation can handle entries and position management while a GSLO (where available) still guarantees the stop price during gaps. The pay-only-if-triggered GSLO of OANDA offers traders protection from slippage by guaranteeing the stop price even when volatility causes price jumps.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

Oanda Features

The features of Oanda are listed below.

- OANDA offers guaranteed stop loss orders on selected products for non US accounts, and OANDA does not provide GSLOs to US accounts.

- OANDA shows the GSLO premium in the ticket and OANDA charges the premium only if the GSLO is triggered.

- OANDA has a $0 minimum deposit for most accounts.

- OANDA is regulated by the CFTC and NFA in the US plus the FCA, IIROC, ASIC, MAS, and other regulators internationally.

- OANDA offers an unlimited demo account and OANDA supports OANDA Trade plus MetaTrader 4 and MetaTrader 5 with TradingView chart integration.

- OANDA EUR/USD typically averages about 1.0 to 1.2 pips on standard spread only pricing.

Oanda Pros and Cons

Advantages of Oanda

The advantages of Oanda are listed below.

- Comprehensive Platforms

- Robust Education

- Highly Regulatory Trust

Disadvantages of Oanda

The disadvantages of Oanda are listed below.

- Higher Spreads

- Proprietary Platform Limitations

- Inactivity Fees

About Oanda

OANDA is a global multi-asset broker founded in 1996, offering trading on forex, CFDs, commodities, indices, and cryptocurrencies. OANDA provides proprietary platforms and API solutions. OANDA is regulated by multiple authorities including FCA, ASIC, and MAS. OANDA is known for competitive spreads, fast execution, and currency data services. OANDA serves both retail and institutional clients worldwide. The Oanda Chief Executive Officer is Gavin Bambury since August 2019.

EasyMarkets

(Best Guaranteed Stop Loss Forex broker for free protection)

easyMarkets is the sixth best guaranteed stop loss Forex broker thanks to free guaranteed stop loss with no slippage by default, fixed-spread pricing with EUR/USD about 1.8 pips, and availability on easyMarkets Web/App plus MT4/MT5 (such as MetaTrader 4 and MetaTrader 5). easyMarkets is a solid option for free protection because stop-loss execution is guaranteed at the chosen price, so you are not charged an extra GSLO premium to avoid slippage. The free guaranteed stop loss feature of easyMarkets protects traders from slippage by enforcing the exact exit price they set.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

EasyMarkets Features

The features of EasyMarkets are listed below.

- easyMarkets guarantees stop loss execution on all trades with zero slippage.

- easyMarkets does not charge a separate GSLO premium because easyMarkets builds the guarantee into its fixed spread model.

- easyMarkets minimum deposit is $100 for its Standard account.

- easyMarkets is regulated by CySEC and ASIC, with additional licenses in other jurisdictions.

- easyMarkets offers an unlimited demo account and easyMarkets supports its web and app platform plus MetaTrader 4 and MetaTrader 5.

- easyMarkets EUR/USD fixed spread is about 1.8 pips on standard terms.

EasyMarkets Pros and Cons

Advantages of EasyMarkets

The advantages of EasyMarkets are listed below.

- Innovative Risk Management Tools

- User-Friendly Platform

- Regulatory Trust

Disadvantages of EasyMarkets

The disadvantages of EasyMarkets are listed below.

- Limited Tradeable Symbols

- Higher Spreads on Some Accounts

- Outdated User Experience

About EasyMarkets

EasyMarkets is a global forex and CFD broker founded in 2001, offering trading on currencies, commodities, indices, cryptocurrencies, and stocks. EasyMarkets provides proprietary web and mobile platforms alongside MetaTrader 4 and 5. EasyMarkets is regulated by multiple authorities including CySEC and ASIC. EasyMarkets is known for innovative features like dealCancellation and fixed spreads. EasyMarkets serves clients worldwide and has received numerous industry awards. The EasyMarkets CEO is Nikos Antoniades.

City Index

(Best Guaranteed Stop Loss Forex broker for spread betting)

City Index is the seventh best guaranteed stop loss Forex broker thanks to GSLOs with no upfront charge and a fee only if triggered, built-in support for spread betting and CFDs, and EUR/USD spreads starting around 0.6 pips (typical 0.8–1.0). City Index is a very good choice for spread betting since its guaranteed stop works like insurance. Your stop executes at the specified price even if the market gaps, and you only pay the premium when the stop is actually hit. The pay-only-if-triggered GSLO of City Index protects traders from slippage by ensuring the position closes at the exact stop level, rather than being filled at a worse price.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

City Index Features

The features of City Index are listed below.

- City Index offers guaranteed stop loss orders and City Index charges the premium only if the GSLO triggers.

- City Index requires setting the GSLO at trade entry, and City Index allows stop level adjustments within allowed ranges.

- City Index has no strict minimum deposit, and City Index recommends around $100 or £100 to cover initial margin.

- City Index is regulated by the FCA, ASIC, MAS, and other regulators under the StoneX group.

- City Index offers a demo account and City Index supports Web Trader, AT Pro, and MetaTrader 4.

- City Index EUR/USD spreads start around 0.6 pips and typical pricing runs about 0.8 to 1.0 pips on standard accounts.

City Index Pros and Cons

Advantages of City Index

The advantages of City Index are listed below.

- Regulatory Trust

- Advanced Trading Tools

- Diverse Market Access

Disadvantages of City Index

The disadvantages of City Index are listed below.

- Limited MetaTrader Options

- Educational Content Gaps

- Customer Support Issues

About City Index

City Index is a global forex and CFD broker founded in 1983, offering trading on currencies, indices, commodities, cryptocurrencies, and stocks. City Index provides proprietary platforms alongside MetaTrader 4. City Index is regulated by multiple top-tier authorities including FCA, ASIC, and MAS. City Index is known for competitive spreads, extensive research tools, and educational resources. City Index is part of the NASDAQ-listed StoneX Group. The City Index’s parent company “StoneX Group Inc.” CEO is Sean O’Connor.

Markets.com

(Best Guaranteed Stop Loss Forex broker for sentiment tools)

Markets.com is the eighth best guaranteed stop loss Forex broker thanks to optional Guaranteed Stop Orders with fees applied only if triggered, Marketsx sentiment tools like Analyst Recommendations and Hedge Fund Trends, and EUR/USD spreads around 0.6–0.7 pips. The Marketsx sentiment suite of Markets.com places it among the good options for sentiment-driven GSLO trading because it lets you pair sentiment signals with a guaranteed stop, so your downside remains capped if the market gaps against your view. The Guaranteed Stop Order option of Markets.com offers traders protection from gapping by locking the exit price, with the fee charged only when the guaranteed stop is triggered.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

Markets.com Features

The features of Markets.com are listed below.

- Markets.com supports guaranteed stop orders on many CFDs, and Markets.com makes GSLO mandatory on all trades for clients residing in France.

- Markets.com shows the GSO fee in advance, Markets.com applies the premium only if the guaranteed stop is triggered, and Markets.com can reduce margin when a GSO caps risk.

- Markets.com minimum deposit is $100 for USD, EUR, and GBP accounts.

- Markets.com is regulated by the FCA, CySEC, FSCA, ASIC, and other regional authorities across its entities.

- Markets.com offers an unlimited demo account and Markets.com supports Marketsx plus MetaTrader 4 and MetaTrader 5 with TradingView use for analysis.

- Markets.com EUR/USD spread typically runs around 0.6 to 0.7 pips on standard pricing.

Markets.com Pros and Cons

Advantages of Markets.com

The advantages of Markets.com are listed below.

- High Trust Score

- Wide Range of Trading Platforms

- Comprehensive Educational Resources

Disadvantages of Markets.com

The disadvantages of Markets.com are listed below.

- Above Average Spread Costs

- Limited Payment Options

About Markets.com

Markets.com is a global online broker established in 2008, offering trading on forex, stocks, indices, commodities, and cryptocurrencies through CFDs. Markets.com provides proprietary web and mobile platforms alongside MetaTrader 4 and 5. Markets.com is regulated by multiple authorities including CySEC, FCA, ASIC, FSCA, and FSC. Markets.com is known for its extensive educational resources and AI-powered trading insights. The Markets.com parent company “Finalto Group” CEO is Matthew Maloney.

Capital.com

(Best Guaranteed Stop Loss Forex broker for AI insights)

Capital.com is the ninth best guaranteed stop loss Forex broker thanks to GSLOs that are free to place but charge a fee only if triggered (shown on the trade ticket), AI-powered analytics that deliver personalized insights, and tight EUR/USD spreads around 0.6–0.7 pips. The pay-only-if-triggered GSLO of Capital.com is a good option for slippage protection because the order ticket shows the exact GSLO cost up front, and you only pay it if the guaranteed stop is triggered. Capital.com is a good choice for AI insights because its AI analytics help surface personalized trading ideas while GSLOs cap downside during gaps, so the worst-case exit price is predefined.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

Capital.com Features

The features of Capital.com are listed below.

- Capital.com offers guaranteed stop loss orders that close trades at the specified price even if markets gap, and Capital.com charges the GSLO premium only if the stop triggers.

- Capital.com mandates GSLO on every CFD position for clients residing in France.

- Capital.com minimum deposit is $20 by card or Apple Pay, and Capital.com uses a $250 minimum for bank wire deposits.

- Capital.com is regulated by the FCA, CySEC, and ASIC, with additional licensing for other regions.

- Capital.com offers an unlimited demo account and Capital.com supports its web and mobile platform plus MetaTrader 4 with TradingView integration.

- Capital.com EUR/USD spreads average about 0.6 to 0.7 pips with no added commission.

Capital.com Pros and Cons

Advantages of Capital.com

The advantages of Capital.com are listed below.

- Advanced Technology

- Low Trading Costs

- Regulated and Secure

Disadvantages of Capital.com

The disadvantages of Capital.com are listed below.

- Limited Protection for Professional Clients

- Charges Inactive Fees

- Not user-friendly

About Capital.com

Capital.com is a global online broker founded in 2016, offering trading on forex, stocks, indices, commodities, and cryptocurrencies through CFDs. Capital.com provides proprietary web and mobile platforms alongside MetaTrader 4 and 5. Capital.com is regulated by multiple authorities including FCA, ASIC, CySEC, and SCB. Capital.com is known for its AI-powered trading insights and extensive educational resources. The Capital.com Group CEO is Kypros Zoumidou.

Forex.com

(Best Guaranteed Stop Loss Forex broker for MT4 EAs)

Forex.com is the tenth best guaranteed stop loss Forex broker thanks to GSLOs available in regions like the UK/EU/APAC (e.g., UK and EU accounts), MT4 support for running Expert Advisors (EAs), and standard EUR/USD spreads around 1.1–1.3 pips. Forex.com is a good option for MT4 EAs because MT4 automation can run continuously while a GSLO (where available) can cap the maximum loss per trade at a fixed price during gaps. The pay-only-if-triggered GSLO of Forex.com offers traders protection from gapping by guaranteeing the stop level, so the exit does not slip beyond the predefined price.

-

Regulations:

-

Avg. EUR/USD Spread:

-

Platforms:

Forex.com Features

The features of Forex.com are listed below.

- Forex.com offers guaranteed stop loss orders in regions such as the UK, EU, and APAC, and Forex.com does not provide GSLO to US accounts.

- Forex.com charges no upfront GSLO cost and Forex.com applies the premium only if the guaranteed stop is triggered.

- Forex.com minimum deposit is $100.

- Forex.com is regulated by the CFTC and NFA in the US plus the FCA, IIROC, ASIC, CySEC, and other regulators worldwide.

- Forex.com offers a demo account and Forex.com supports its proprietary Web Trader plus MetaTrader 4 and MetaTrader 5.

- Forex.com EUR/USD typically averages about 1.1 to 1.3 pips on standard pricing, and Forex.com offers raw spread pricing with commission in some regions.

Forex.com Pros and Cons

Advantages of Forex.com

The advantages of Forex.com are listed below.

- Regulatory Assurance

- Low Forex Fees

- Comprehensive Educational Resources

Disadvantages of Forex.com

The disadvantages of Forex.com are listed below.

- Limited Product Portfolio

- Higher Spreads on Standard Accounts

- No Guaranteed Stop-Loss Orders for U.S. Clients

About Forex.com

FOREX.com is a global forex and CFD broker founded in 2001, offering trading on currencies, commodities, indices, stocks, and cryptocurrencies. FOREX.com provides proprietary platforms alongside MetaTrader 4 and 5. FOREX.com is regulated by multiple top-tier authorities including FCA, ASIC, and CFTC. FOREX.com is known for competitive spreads, fast execution, and extensive educational resources. FOREX.com serves over 450,000 clients worldwide. The FOREX.com’s parent company “StoneX Group Inc.” CEO is Sean O’Connor.

Comparison of the best guaranteed stop loss forex brokers

The table that compares the best guaranteed stop loss forex brokers is shown below.

| Broker | GSLO availability on major FX pairs | GSLO premium charging model | GSLO post-entry modification policy | Typical EUR/USD all-in cost pips | Primary regulator for the account entity |

|---|---|---|---|---|---|

| IG | Yes (CFD & spread betting; broad instruments; jurisdiction varies) | charged only if triggered | N/A (policy not specified) | 0.8–0.9 pips (typical; standard spread-only) | FCA (UK) (also ASIC, CFTC/NFA, MAS and others, depending on entity) |

| CMC Markets | Yes (most CFD/spread betting instruments; availability shown per instrument) | charged only if triggered | Can be placed/modified during market hours; min distance; can cancel/switch back to normal stop | 0.7 pips (typical; standard spread-only) (alt: 0.6 pips on FX Active) | FCA (UK) (also ASIC, MAS and others, depending on entity) |

| OANDA | Yes outside US (on major FX pairs and certain CFDs); No for US accounts | charged only if triggered | N/A (policy not specified) | 1.0–1.2 pips (typical; standard spread-only) (alt: 0.6 pips Core Pricing) | FCA (UK) / ASIC (AU) / CFTC-NFA (US) (depending on entity) |

| easyMarkets | Yes (guaranteed stop loss/no slippage by default on easyMarkets trades) | embedded in spread/fixed-spread model | N/A (policy not specified) | 1.8 pips (fixed; standard account) | CySEC (EU/Cyprus) / ASIC (Australia) |

| City Index | Yes (spread betting/CFDs; optional) | charged only if triggered | Entry-only; cannot remove after set; can adjust level within allowed ranges | 0.8–1.0 pips (typical; standard spread-only) | FCA (UK) (also ASIC, MAS and others, depending on entity) |

| Forex.com | Yes in certain regions (UK/EU/APAC); No for US accounts | charged only if triggered | N/A (policy not specified) | 1.1–1.3 pips (typical; standard spread-only) (alt: 0.7 pips on Raw/Commission pricing) | CFTC-NFA (US) / FCA (UK) / ASIC (AU) / IIROC (Canada) / CySEC (EU) (depending on entity) |

| Plus500 | Yes (select instruments only; platform indicates availability) | embedded in spread/fixed-spread model | Entry-only; cannot add after opening; cannot be removed once set | 0.8–1.1 pips (typical; standard spread-only) | FCA (UK) / ASIC (AU) / CySEC (EU/Cyprus) (depending on entity) |

| Markets.com | Yes (region-dependent); France: mandatory GSLO on positions | charged only if triggered | N/A (policy not specified; France: GSLO mandatory) | 0.6–0.7 pips (typical; standard spread-only) | CySEC (EU/Cyprus) / FCA (UK) / FSCA (South Africa) / ASIC (AU) (depending on entity) |

| Capital.com | Yes (broad availability); France: GSLO mandated on every CFD position | charged only if triggered | N/A (policy not specified; min distance rules noted) | 0.6–0.7 pips (typical; standard spread-only) | FCA (UK) / CySEC (EU/Cyprus) / ASIC (Australia) (depending on entity) |

| XTB | No | N/A | N/A | 0.7–1.0 pips (typical; Standard spread-only) | FCA (UK) / CySEC (EU/Cyprus) / KNF (Poland) (depending on entity) |

Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

The best Guaranteed Stop Loss Forex broker with MT4 is CMC Markets. CMC Markets stands out thanks to GSLOs on most instruments with the premium refunded if unused, MT4 alongside its Next Generation platform, and tight FX pricing. Those strengths mean you can trade on MT4 while getting broad gap protection, keep costs down when the GSLO isn’t triggered, and benefit from competitive pricing on major FX pairs.

Solid MT4 execution, predictable GSLO cost rules, and competitive spreads are hallmarks of the best MT4 GSLO Forex brokers. IG is a good alternative to CMC Markets and is frequently featured among the MT4 Forex Brokers because it supports MT4, charges the GSLO fee only if triggered, and offers sharp FX spreads. OANDA also works well as an alternative to CMC Markets, especially since it provides MT4, offers GSLOs on supported non-US products with a trigger-only premium, and has a $0 minimum deposit.

The best Guaranteed Stop Loss Forex broker with MT5 is Markets.com. Markets.com is a great fit in this context due to its MT5 support, Guaranteed Stop Orders (region-dependent), and tight EUR/USD pricing. With MT5 access plus GSLO availability where supported, traders can run MT5 strategies while reducing gap-risk exposure and keeping major-pair trading costs competitive.

The strongest MT5 GSLO brokers usually deliver MT5 access, reliable guaranteed-stop availability, and low-cost FX trading. A similar alternative to Markets.com is OANDA for MT5 support via international entities, GSLOs on supported products (not for US accounts), and a $0 minimum deposit. easyMarkets offers similar features to Markets.com like free guaranteed stop loss/no slippage, MT5 compatibility, and a beginner-friendly proprietary platform with a demo, making it one of the top MT5 Forex Brokers.

The best Guaranteed Stop Loss broker with low spread is CMC Markets. CMC Markets earns the top spot with tight FX spreads (including FX Active-style pricing), GSLO premium refunds when unused, and strong platform tooling via Next Gen plus MT4. In practice, that mix helps active traders reduce ongoing spread costs, avoid paying for protection that never triggers, and manage trades efficiently with robust charting and order controls.

Spread-sensitive traders look for aggressive pricing, transparent GSLO charging, and strong platforms in the best low-spread GSLO brokers. Capital.com offers very tight spreads, a GSLO fee only if triggered, and a low minimum deposit that make it an alternative to CMC Markets and it is widely mentioned as one of the leading Forex brokers with low spread. Markets.com offers similar features to CMC Markets like tight spreads, Guaranteed Stop Orders (where available), and MT4/MT5 support for platform flexibility.

The best Guaranteed Stop Loss broker for beginners is Capital.com. Capital.com works especially well for new traders thanks to its very low minimum deposit, simple platform with an unlimited demo, and GSLO pricing where the fee applies only if triggered. That setup lowers the barrier to getting started, lets beginners practice extensively before committing real funds, and keeps risk-control costs predictable when using guaranteed stops.

Beginner-friendly GSLO brokers usually feature easy-to-use platforms, accessible account minimums, and straightforward stop-loss protection rules. Plus500 is an alternative to Capital.com because it provides a very simple platform, an unlimited demo, and Guaranteed Stop Orders on select instruments, placing it among the top Forex brokers for beginners. easyMarkets is another alternative to Capital.com, mainly due to its free guaranteed stop loss/no slippage, beginner-oriented tools like dealCancellation, and access via MT4/MT5 plus its proprietary platform.

The best Guaranteed Stop Loss broker for Spread Betting is CMC Markets. CMC Markets is particularly strong here because it combines spread betting with GSLO support, offers premium refunds when the GSLO isn’t used, and delivers a feature-rich Next Generation platform. This can be valuable for spread bettors who want robust charting and risk tools, plus the reassurance of guaranteed exits without paying extra if protection never gets triggered.

Spread betting access, GSLOs with sensible fee rules, and high-quality platforms of the best spread betting brokers are highly regarded by traders. IG offers similar features to CMC Markets like spread betting with GSLOs, a GSLO charge only if triggered, and a well-established platform suite under strong regulation. City Index offers GSLOs with trigger-only fees, multiple platforms including Web Trader and MT4, and competitive spreads that make it an alternative to CMC Markets and a great Forex broker for Spread Betting.

The criteria for choosing the best Guaranteed Stop Loss brokers are listed below.

- GSLO availability: Verify that the broker’s regulated entity for your country supports Guaranteed Stop-Loss Orders on the asset classes you trade (e.g., major FX pairs, indices, gold, single stocks). Prioritize brokers with broad GSLO coverage (e.g., CMC Markets GSLO on most CFD/spread-betting instruments) over partial coverage (e.g., Plus500 GSOs on select instruments, and OANDA GSLOs only on certain products and not for U.S. accounts). Treat “no GSLO” as disqualifying if the strategy requires gap protection.

- Order-rule flexibility: Select brokers whose GSLO rules match your execution workflow. Confirm whether GSLOs can be added after entry, modified, or removed, and whether there are market-hours or minimum-distance constraints. Prefer flexible implementations (e.g., CMC Markets allows GSLO placement/modification and refunds the premium if unused) over restrictive ones (e.g., Plus500 requires the GSO at trade entry and it cannot be removed once set). This criterion is critical for managing weekend gaps and macro events.

- Premium and refunds: Quantify the insurance cost model and align it with GSLO usage frequency. Favor conditional pricing (fee charged only if triggered) used by IG, CMC Markets, OANDA, City Index, and Capital.com. Note that CMC Markets refunds the premium if the GSLO is not triggered. Contrast this with embedded pricing (e.g., Plus500 widens the spread when a GSO is set and easyMarkets prices risk into fixed spreads such as 1.8 pips on EUR/USD).

- Regulation and safeguards: Prefer tier-1 regulated broker groups and open the account under the strongest applicable regulated entity (e.g., FCA-regulated IG Group; CMC Markets under FCA/ASIC/MAS; OANDA with CFTC/NFA in the U.S. plus FCA/ASIC/MAS/IIROC elsewhere). Require segregated client funds, negative balance protection, and clear disclosure of GSLO limitations by jurisdiction.

- Total trading costs: Compare typical spreads/commissions and incorporate GSLO premiums into expected cost per trade. Use EUR/USD all-in costs as a benchmark. IG offers 0.6–0.9 pips, CMC Markets 0.7 pips (or FX Active with raw spreads plus $5 per lot), Markets.com/Capital.com 0.6–0.7 pips, OANDA 1.0–1.2 pips, easyMarkets 1.8 pips fixed, and Plus500 0.8–1.1 pips plus $10/month inactivity after 3 months. Prefer brokers where all-in cost remains competitive with frequent GSLO use.

- Platforms and demo testing: Require platform-level GSLO support and validate in a demo before funding. Examples include IG (proprietary + MT4), CMC Markets (Next Generation + MT4, TradingView), OANDA (OANDA Trade + MT4/MT5), Capital.com (proprietary + MT4), and Markets.com (Marketsx + MT4/MT5). Prefer brokers with low minimum deposits (e.g., Capital.com $20, Plus500/easyMarkets/Markets.com $100, while IG/OANDA $0 minimum) and sufficiently long demos (e.g., unlimited demos at IG/CMC/OANDA/Plus500 versus time-limited demos such as 4 weeks XTB, 30 days Forex.com, 12 weeks City Index).

To evaluate slippage when choosing a Guaranteed Stop Loss broker, you should assume 0 pips of stop-out slippage on instruments where the broker truly guarantees the stop fill at your exact level, and then measure the slippage that remains (entry, take-profit, stop-entries, and any non-guaranteed stops).

Slippage is the difference between your reference price (the quote at click for market orders, or the trigger/limit price for pending orders) and the executed fill price. Build evidence from broker execution disclosures (price-improvement and slippage metrics) and your own controlled test on the platform you will actually use (MetaTrader, proprietary web/mobile, or API).

In a controlled test, make 50 to 100 small trades during your usual trading sessions, and add one session during a high-volatility period, such as a major data release or the market open. For each trade, record the time, the spread, the order type, the requested price, and the actual fill price. Then calculate slippage in pips and compute the mean, median, and 95th percentile separately for buys and sells. The 95th percentile gives a good idea of worst-case execution risk, showing how bad slippage can get in the tail.

Prefer brokers that let you limit slippage automatically, for example with boundary or tolerance-based orders that reject fills outside the range you set. Finally, check the broker’s GSLO rules carefully, minimum distance requirements, whether you can add or modify a GSLO after entering a trade, and whether the extra premium is refunded if the GSLO is not triggered, because these constraints affect how much control you really have over execution risk.

To verify negative balance protection terms before selecting a Guaranteed Stop Loss broker, you should confirm that your maximum liability is limited to the cash in your CFD/FX account (ie, you can owe €0 beyond your deposited funds) under the broker’s regulated entity and your client classification.

Start by identifying the legal counterparty on your account opening documents (eg, FCA-regulated UK entity, CySEC-regulated EU entity, ASIC-regulated Australian entity). Negative balance protection (NBP) is not a universal “brand feature”, it is an entity-dependent obligation. In the EU/UK retail CFD regime, regulators require a 50% margin close-out and per-account NBP, meaning losses cannot exceed the funds held in the account.

Then read the broker’s Client Agreement and Risk Disclosure for three items:

- Scope: Which products are covered (CFDs on FX/indices/commodities, options, shares) and whether NBP is per account or per position.

- Client category: Retail vs professional/elective professional; protections can fall away when you opt into professional status.

- Mechanics: When and how the broker “resets” a negative balance after gaps, and whether exclusions exist for fees, chargebacks, or non-trading debts.

Finally, obtain written confirmation (support ticket or email) that NBP applies to your account type and to the instruments where you intend to use GSLOs, because GSLO and NBP are separate protections.

To compare guaranteed stop loss fees when choosing among Guaranteed Stop Loss brokers, you should normalize every broker into expected GSLO cost (pips): Expected cost = upfront premium + P(trigger) × conditional premium, then add the spread/commission difference for the same instrument and trade size.

Fix one test case (eg, EUR/USD, your typical size, same stop distance) and read the GSLO premium from each broker’s ticket before placing the trade. IG and OANDA state the premium is charged only if the GSLO triggers. If it never triggers, you pay nothing for the guarantee.

CMC Markets typically applies a refundable, conditional premium: the platform shows a GSLO premium, and if the guaranteed stop is not triggered (for example, you close the position manually, a take-profit closes it, or you replace the GSLO with a regular stop), the premium is generally refunded, so the “insurance cost” is paid only when the guarantee is actually used.

Plus500 generally applies a non-refundable premium via a wider spread: the cost of the guaranteed stop is effectively embedded in the pricing, and once the position is opened with the guaranteed stop mechanism, that premium is typically not refundable, with the feature often restricted to being set at the time of opening rather than added later.

Some brokers use a model where the guarantee is embedded in the spread or fixed pricing structure rather than presented as a separate ticketed fee, which shifts the GSLO cost from an explicit premium into the ongoing execution cost you pay through the spread (and, depending on the broker, commissions).

Finally, convert each premium into pips (or account currency) per trade and weight it by your strategy’s observed stop-hit rate. This yields a comparable “insurance cost” per trade that you can rank alongside spreads and financing.

To understand how volatility affects guaranteed stop loss availability at Guaranteed Stop Loss brokers, you should assume the effect is restrictive. Higher volatility tends to increase minimum GSLO distances, limit when you can place/modify GSLOs, and sometimes remove GSLO eligibility on specific instruments.

A Guaranteed Stop-Loss Order (GSLO) transfers gap and fast-market execution risk from you to the broker, so brokers manage that exposure with hard rules. CMC Markets states GSLOs must be set at least a minimum distance from the current price and can only be placed during trading hours. OANDA describes minimum-distance criteria and that GSLO modifications are constrained outside market hours.

Volatility also changes the economics of the guarantee. Premiums and spreads can widen around major announcements, even though a GSLO, once accepted, still exits at the specified level. Plus500 similarly discloses predefined distance rules and trading-hours limits for guaranteed stops, which can make GSLOs unavailable precisely when markets are most disorderly.

Practically, test availability by checking the GSLO option on your target instruments across normal hours, market open, and a scheduled macro release, record whether GSLO is offered, the minimum distance, and the premium shown on the ticket. Prefer broad coverage and flexible modification rules if you trade event risk frequently, especially during heightened volatility.